The main outline of the primer was written originally by Tiffany Tai, and turned into a post with new content from Joanna.

Everyone wants to be tight with Gartner – and you can too. This is an intro into Gartner that will serve as a primer for how you can build your analyst relations strategy.

Every start-up (young or in an emerging category) I talk to these days mentions wanting to be tight with Gartner. And every start-up I talk to seems to think that they can buy their way into Gartner.

What is Gartner?

First off, let’s start with level-setting who and what Gartner is and what they do.

Gartner is a global research and advisory firm providing insights, advice, and tools for leaders in IT, Finance, HR, Customer Service and Support, Legal and Compliance, Marketing, Sales, and Supply Chain functions. This research has historically targeted CIOS, senior IT, marketing, and supply chain leaders, though with recent acquisitions, they have expanded their offerings to support most business functions in every industry and enterprise size.

They have a client base of ~15,000 organizations in over 100 countries, with products and services that include research, executive programs, consulting, and events.

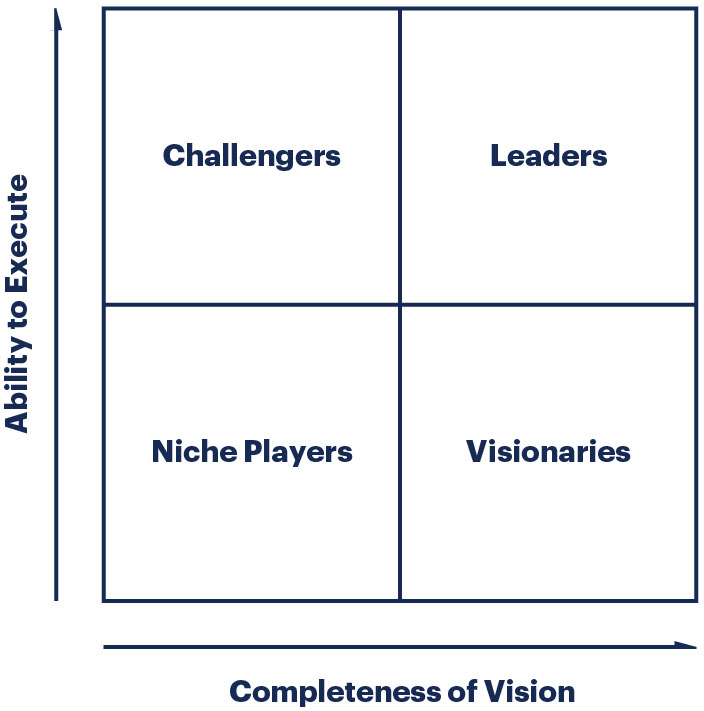

Gartner leverages visuals such as the Magic Quadrant for visualization of its market analysis results.

What is the Magic Quadrant?

The Magic Quadrant (MQ) is published once per year per market or category group. You can see a full list of their publishing schedule here.

The MQ categorizes technology providers into the following buckets: Leaders, Visionaries, Niche Players, and Challengers. These categories are based on the providers’ ability to execute and completeness of vision, as visualized below.

Completeness of Vision considers the features and capabilities of a product offering and the innovations that are planned.

Ability to Execute considers revenue, employees, number and quality of resellers and distributors (if applicable), and other business factors.

An MQ provides a graphical competitive positioning of four types of technology providers, in markets where growth is high and provider differentiation is distinct:

- Leaders execute well against their current vision and are well positioned for tomorrow.

- Visionaries understand where the market is going or have a vision for changing market rules, but do not yet execute well.

- Niche Players focus successfully on a small segment, or are unfocused and do not out-innovate or outperform others.

- Challengers execute well today or may dominate a large segment, but do not demonstrate an understanding of market direction.

Every start-up may believe that they want be included within the “Leader” category of the MQ, however Gartner notes that not all vendors in the Leader category are necessarily the right choice for those searching for technology providers, as needs will be different depending on the situation.

Understanding the landscape and also where your industry is heading will help you anticipate where you may fall on the MQ. If you do not have this understanding of the industry, leverage a paid relationship with Gartner.

One of the key benefits to having a (PAID) relationship with Gartner is the ability to ask the analysts questions and their perspectives on the industry. You can use their advice to make changes and position yourself well for the future (either with the MQ or other reports).

Resources

- How Markets and Vendors Are Evaluated in Gartner Magic Quadrants

- Magic Quadrant FAQ

- Magic Quadrants Research

- Magic Quadrant Publishing Calendar

What MQ should I be on?

Well, what category are you in? If it’s an emerging category, there likely has not been an MQ published, and maybe not for some time. You can usually tell where Gartner is focused depending on their Hype Cycle releases.

WTF is a Hype Cycle?

Honestly, I don’t know who comes up with this BS, but it’s a thing that Gartner created to show you where technologies are within the market in relation to maturity. Definition from Gartner below.

The Hype Cycle is a graphical depiction of a common pattern that arises with each new technology or other innovation. Although many of Gartner’s Hype Cycles focus on specific technologies or innovations, the same pattern of hype and disillusionment applies to higher-level concepts such as IT methodologies and management disciplines. In this document, we refer to the individual elements mapped on the Hype Cycles as “innovation profiles.” But in many cases, the Hype Cycles also position higher-level trends and ideas, such as strategies, standards, management concepts, competencies and capabilities.

Source: “Understanding Gartner’s Hype Cycles” August 2018

Having an idea of where your category is on Gartner’s radar is a great start. If it’s headed toward the Slope of Enlightenment, you’re looking good for an MQ to be created very soon – but note, you may be a bit late in getting on their radar.

For understanding Hype Cycle methodology – you should read “Understanding Gartner’s Hype Cycles” and take a look at their Hype Cycles (you have to log-in to view).

What is the roadmap to a MQ?

Admittedly, having that (very expensive) paid relationship with Gartner does give you an inside scoop. A Gartner Account Manager that supported me previously gave a lot of insight into timing and analyst involvement. If you’re marketing professional who can read between the lines, you can semi-accurately predict when an MQ will be published.

First of all, the MQ is not the first thing they publish. They often start with a Market Guide that is just a list of vendors that they believe fall into a specific category. They’ll then expand the Market Guide to include descriptions for the vendors as they’re defining what makes a vendor qualify for that category. Generally, surveys will be sent out asking vendors to respond. These surveys can be very technically deep, so make sure you include a cross-functional team to respond (e.g.: Don’t let your sales team respond to all the answers… make sure to include product and engineering).

Depending on where your category is trending, an MQ may be close on the horizon or far out. Definitely do a little bit of snooping and back channeling to try to identify the timing for this.

Can I or should I “buy” my way in?

As noted from Analyst Relations 101: “Paying for a relationship does not guarantee any sort of outcome or preference for your business, therefore it’s far better to have a clear strategy in how you interact with them and what information you would like to convey.“

In an ideal world, having a strategy of regularly scheduled interaction through briefings, having consistent newsworthy* news to share, and building relationships through networking (example: the best relationships are the ones where analysts come to you to ask for feedback or advice because they’ve identified that you are a source of valuable POVs).

If you do buy your way in, be smart about how you approach Gartner during an inquiry – remember there’s a briefing (you brief Gartner on what’s going on) versus an inquiry (you ask them for feedback). Analyst are consistently annoyed when vendors get on calls unprepared, offer nothing interesting to say, or use an inquiry as a briefing session. They won’t say this to your face – as you are *GASP* a paying customer – but these are smart people and word gets around.

Lean on your PR team (who ideally has experience working with analysts) to give you briefing docs, do prep work, and get you set up for success!

*Newsworthy – I stress that every company somehow thinks that whatever crap they are shilling is news – NOT TRUE! Consult a PR pro on what would be interesting to an analyst or reporter.

Related posts

Analyst Relations 101, October 2019

Header Photo by Bee Felten-Leidel on Unsplash